Employment Recovers

Just a very quick note regarding last week’s employment numbers.

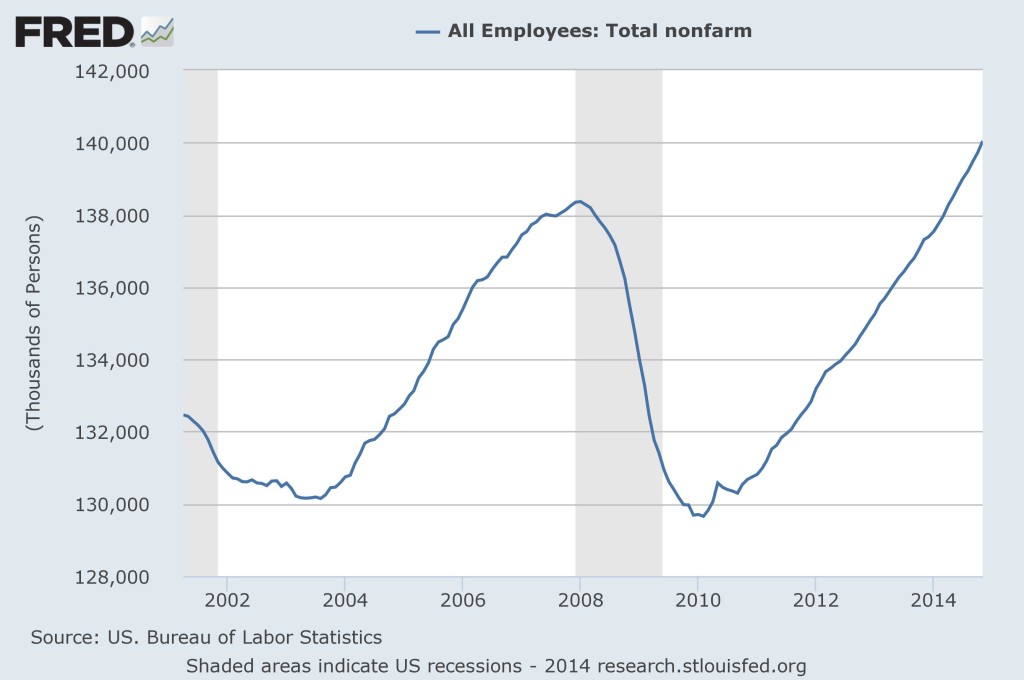

They were good. That’s all we need to know. It’s been a long time since I have reported on the economy here, I have been distracted by my journey into the relationship between democracy and capitalism. But, since a couple of you asked, here is a comparison between the two most recent recessions and subsequent recoveries:

I think it is pretty clear that our current and still ongoing recovery was more substantial than that during the Bush years after 2001. When you look closely you can see that total employment at the end of the Bush administration was almost the same as it was at the beginning. In other words the entire eight years produced negligible progress, with all the gains after the earlier recession being offset by the dramatic collapse in 2008.

In contrast, the Obama years have seen steady improvements throughout, with that minor exception at the end of 2010 and the beginning of 2011.

Clearly Obama has been better at job creation than Bush.

Having said that, of course, I would not endorse recent economic policy which has, by and large been on the timid side of tepid. We could have had faster growth in jobs and the economy at large had the Republicans not obstructed each and every attempt to reflate thee economy. That is now, however, an academic argument.

What is clear is that the nature of both recent recessions was substantively different from those we were used to in the earlier post-World War II years. Those earlier recessions were forced on us by the Federal Reserve Board aggressively tightening money supply in order to choke of what it thought of as too rapid a pace of growth. Because those recessions were ‘artificially’ created they could also be easily undone. The Fed simply had to reduce interest rates when it had the pace of growth under control and the threat of inflation had subsided. These recessions thus tended to be short, with sharp job losses offset by sharp gains once the Fed eased.

Unfortunately these ‘artificial’ recessions are a thing of the past. Both the recessions whose employment numbers are plotted on the chart above began life as private sector adjustments. They were not created by the Fed, but were consequences of over-reach and then retrenchment by businesses and households. They have proven to be much more difficult to recover from, with monetary policy being much less effective than we had become used to in earlier post-war decades. One salient feature of these more modern recessions is that while job losses have been sharp, as they were before, the recovery in employment has been a much longer, more painful, affair.

This need not have been the case: the relative powerlessness of monetary policy could have been augmented by a more aggressive reflationary fiscal policy. In other words, the demand side of the economy could have been given a positive jolt to get employment recovering more rapidly than was likely under ‘normal’ circumstances.

This, however, would imply that the government can play an active and positive role in managing the economy. Since this is anathema to right wing politicians, they preferred to let the economy fester, rather than encourage action.

While this was callous and did great harm to millions of Americans, it allowed the Republicans to use the meager recovery as a political weapon – as the recent elections so dramatically demonstrate. It is a shame when one of our political parties acts so cynically, but that’s the way Washington is nowadays.

In any case: Those of you who are on the left of the spectrum can take heart in knowing that the Obama years have been good for the economy by and large. And that the recovery is better than anything we saw under Bush.