Flat Earth Rules

Economists, especially mainstream economists, often like to ignore the real world consequences of their theories. Instead they prefer to hide away pretending that their conversations and ideas leave no imprint on society, and that their simple little models are just representations designed to cut through the tangle of reality to get at some core truth. Only in the grand world of macroeconomics is this not true. There, economists love to strut about as if they hold the keys to universal insights untroubled by the somewhat ambiguous results their ideas appear to inflict on the rest of us.

The fact that there are economists on all three sides of any two sided argument ought be sufficient to let us know that their insights are a little vague, and highly dependent on each individual economists worldview. Economics, it seems sometimes, is little more that highly formalized opinion.

This is not meant to demean economics, I think it is a subject worthy of high regard, I mean only to alert us all to its manifest weaknesses and deeply ingrained biases. Only economists could possibly imagine into being something as absurd as dynamic stochastic general equilibrium, or representative households, or the non-accelerating inflation rates of unemployment, or growth models where the unexplained residual accounts for there-quarters of growth. All these could be dismissed as arcane academic nonsense were they not essential to the policy making that affects everyday lives of hundreds of millions of people.

It is because of this policy impact that economics ought have a well developed ethical standard for its researchers – something like “first do no harm” would be a good place to start – but economics being the home of a group of people who look askance at organized or social anything steadfastly refuses to look inward at its ethical responsibility. After all, they argue, the mar ket will take care of weeding out the rotten apples.

Sure.

But here I am not concerned with macro which is, despite my deep skepticism, the part of economics that has some, albeit it cartoonish, relationship with reality. No, the part of economics that is truly messed up is micro. And by messed up I mean really messed up. Rational choice? Really? Microeconomics makes no pretension whatsoever about connecting with the real world. It just exists in its make-believe world of agents – not people – running around in a kind of utopian information rich hyper-individualistic flat earth like place where the vistas are the same in every direction, where choice is a singularity driven by machine like logic, and where anything resembling humanity is scrunched aside in order to make life easy for economists. All those individuals defy the meaning of individual because true autonomy would surely introduce variety, and variety dirties the purity of economics. So out variety must go.

This would be all well and good were it contained within economics. Who would care? No one. The rest of us could look on and laugh at the silliness of it all.

But we ought not laugh: economics is really dangerous stuff. Sometimes I think it should be banned – it’s that dangerous.

You see, economics has infected other disciplines. Its ideas have migrated and brought their lax ethics into places where they can do enormous damage.

Like into business schools.

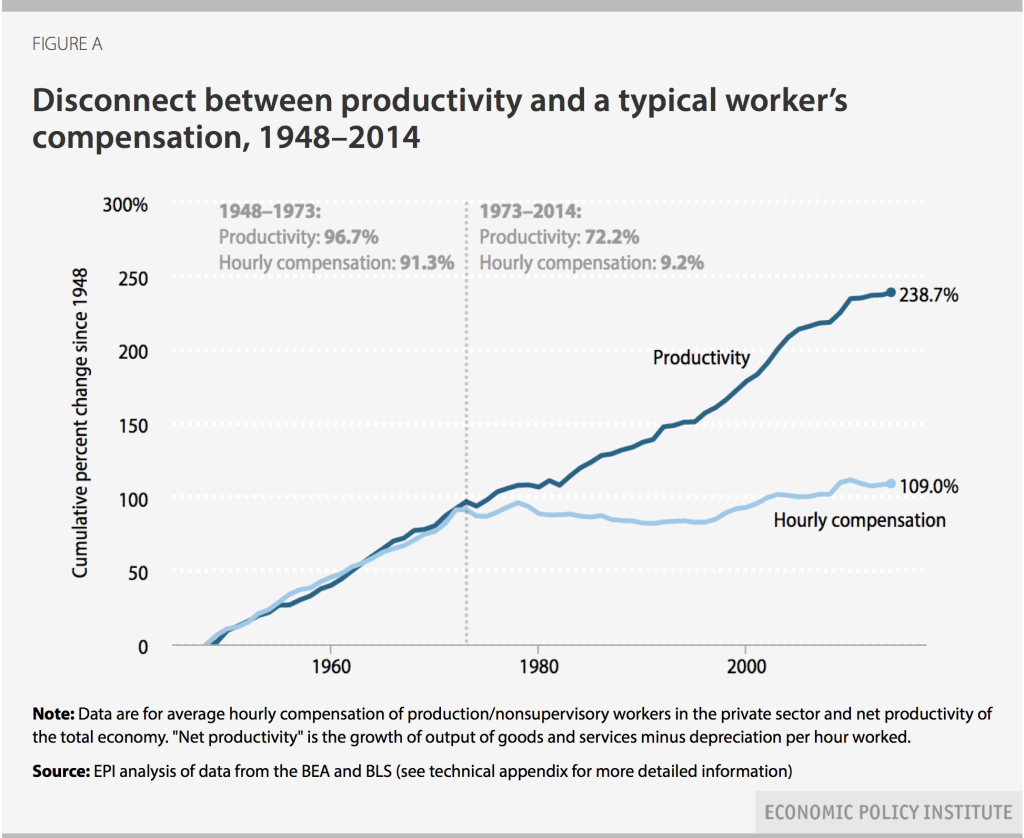

Take a look at this chart:

Familiar?

It ought to be. It has been making the rounds in one form or another for a while now. A friend of mine just sent it to me and asked for an explanation. How come wages have not kept up with productivity.

Now economists of all stripes and opinions have their own views. Globalization. Class structures. Technological change. The demise of unions. And many more.

I tried to think of something different to tie those things together.

My thought is that the cause of the great divergence between wages is due to the notion of shareholder value.

Huh?

Look at the date of the onset of the divergence. It is coincident with the rise of modern management theories being peddled at business schools. Central to the panoply of ideas of modern management is shareholder value.

What is this?

It is the pernicious idea that the single and only valid focus of corporate management is to maximize the value of the corporation in the hands of its shareholders. Nothing else matters. Nothing. The thought of ‘stakeholders’ is anathema to shareholder value theorists. Milton Friedman – yes he was an ardent advocate of the new idea – was apoplectic at the thought that management had any other goal.

Why?

Because in the flat earth of Friedman’s microeconomics every agent is doing the same ting: looking out for number one. Further, they are all capable of doing so. Because standard microeconomics has embarrassingly little to say about business as it actually exists, Friedman’s extraordinarily naive perspective is consistent with his equally naive theories of human behavior. In such a flat earth businesses are little more than single person entrepreneurs who struggle perpetually to eke out a living in fierce competition, and they see to maximize their incomes – just like everyone else – in a world flooded with information.

So workers, customers, society, the environment, trade unions, and other sundry so-called ‘stakeholders’ had no place in Friedman’s rubric other than they are could be manipulated to maximize shareholder return. Let me repeat: nothing else mattered. Because microeconomics is so restricted and divorced from reality people like Friedman could argue for shareholder value with straight, if disingenuous, face.

This startlingly narrow view of the world would be fine had it not then become the intellectual basis for the notion of shareholder value business schools began to teach. What was sensible in the world of economic fiction then became the basis for real world drama.

Since business schools operate in that real world – their graduates are destined to to actual jobs and not just manipulate equations – what they teach has a great impact on business. Real business, not the unreal business of economics. The intellectual roots of modern management are back deep in Friedman-like make believe.

Just as modern economics was invaded and corrupted by the purity of rational choice and its associated fictions, so too was management theory.

The problem is, of course, that unlike the caricatures of economics, actual businesses are not governed by the so-called laws of economics. And, more to the point, they are sufficiently large to impress their values union society.

Strategy negates and plunders the pristine world of microeconomic nirvana. Business schools only teach microeconomics so as to identify ‘market failures’ or ‘niches’ where a good profit can be made. The real world is about creating opportunities for rents not profits.

Gradually the notion of shareholder value was pressed into service to justify the relegation of labor to an expense to be minimized rather than as resource to be valued; to justify the remuneration of managers who delivered cost reduction by offshoring manufacturing; to justify the adoption of financial structures that privileged debt in corporate balance sheets; to justify the steady shift of national income towards capital away fro labor; to justify the explosion of so-called global logistics; to justify the resistance to alarm over the environmental damage of some production; to justify resistance to the adoption of sustainable business practice; and to justify the explosion in CEO pay.

All of which, cumulatively, re-created the business environment and produced the divergence between pay and productivity in the chart above.

In retrospect I think it fair to say that modern management theory, and shareholder value in particular, can be seen as a technology developed from the intellectual parent we know as neoclassical economics. Shareholder value, by taking the claims of its utopian forbears seriously, ends up perverting them. It is, in my view, weaponized neoclassical economics. It became the sharp end of the performative effort of modern economists to transform the economy in the image of their flat earth nonsensical ideas. After all if the world can be flattened, a flat earth theory starts to look more sensible, and flat earth believers start to look more astute.

Meanwhile, as that chart shows, the consequences of ideas can be devastating. The collateral damage of the attack on reality by our flat earth economists is very real.

But, as I said at the beginning, economists, especially mainstream economists, often like to ignore the real world consequences of their theories. After all they can always claim to know nothing about business, business schools, or any other practical thing. Who could possibly know that rational choice and all that marginal talk might get, well, taken seriously?